For 13 years of the ever-expanding martech panorama, typical knowledge has predicted that our trade would consolidate.

That typical knowledge has failed spectacularly.

Or extra precisely, the standard knowledge of the software program trade from 10, 20, 30 years in the past has been disrupted by new dynamics, in a brand new surroundings. The boundaries to creating software program are a fraction of what they as soon as had been — and are quickly shrinking additional with AI. The boundaries to distributing software program have collapsed (albeit whereas the prices of promoting and promoting software program at scale have risen as competitors has multiplied). Even the thorny boundaries to integration are steadily falling as an open information layer, APIs, and platform ecosystem requirements proliferate within the everything-is-adjacent cloud.

It’s in no way an ideal surroundings. There are nonetheless loads of challenges, together with a raft of recent, undesirable unwanted effects from this Cambrian explosion of apps. However it’s a totally different surroundings than the software program trade of yesteryear. It’s one the place pure consolidation methods amongst distributors have been unable to maintain tempo.

I normally talk about the implications this has for entrepreneurs and advertising and marketing operations groups. How ought to they adapt to this surroundings? (I humbly counsel the New Guidelines of Advertising Know-how & Operations as one useful framing, in addition to a perspective on aggregation inside tech stacks, each horizontal and vertical.)

However right this moment I’d wish to suggest a mannequin for the way martech companies may very well be aggregated.

We’d like a brand new path for profitable “lengthy tail” apps

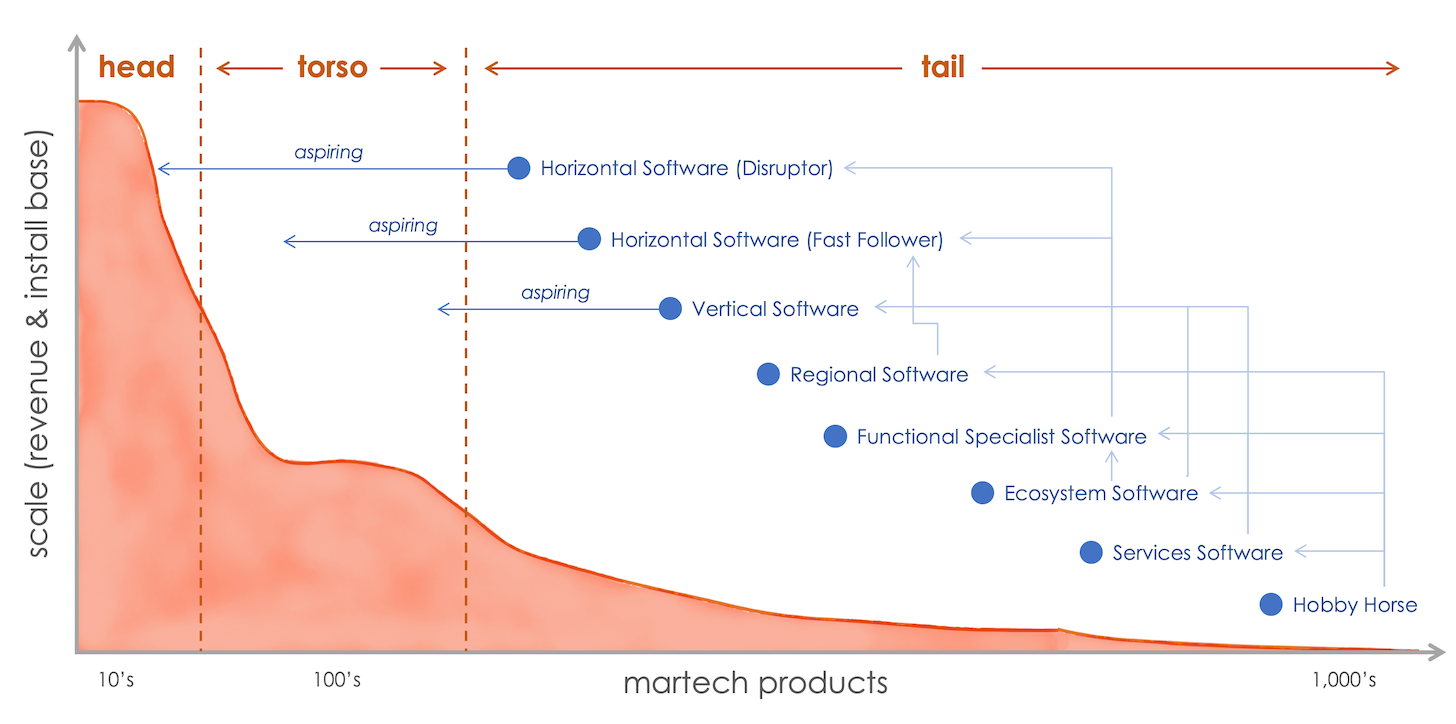

The size of firms within the martech panorama has an extended tail distribution. There are a pair dozen massive, public firms within the head. A couple of hundred best-in-class leaders within the torso. After which hundreds of small ventures within the tail. Approximating their orders of magnitude in income, the pinnacle are $1+ billion companies, the toroso are $100+ million, and the lengthy tail are usually $10 million or much less.

Within the conventional mannequin of anticipated consolidation, each firm aspired to climb up that hill to better and better income. Bold startups on the far finish of the tail aspired to grow to be juggernauts within the head someday — and lots of raised eye-watering sums of cash from VCs to attain that aim.

After all, few ever reached the rarified air of that highest echelon within the head. A couple of did, which — because of the delusion of survivorship bias — egged on extra startups and their VC enablers to aim the ascent. Others took the short-cut of being acquired by a bigger firm within the head or torso. These exits had been much less thrilling than an enormous, fats IPO. However they had been extra widespread, usually 100-200 per yr. And so they may very well be profitable sufficient exits for founders and their buyers that this path grew to become the dominant exit technique for many funded martech ventures.

However that’s nonetheless a small variety of exits relative to the whole inhabitants of martech firms. What about the remaining? Some merely went out of enterprise or had been offered for scrap. Others hit a income ceiling and, nicely, kinda obtained caught there. Some made peace with that pure restrict to their scale. That was typically simpler in the event that they didn’t have VC buyers banging on the desk and “Uzi-ing execs within the parking zone”, because the colourful metaphor goes. However within the absence of a viable exit on the horizon, many slipped right into a grey state generally known as the strolling lifeless. Alive, however in a shambling form of method.

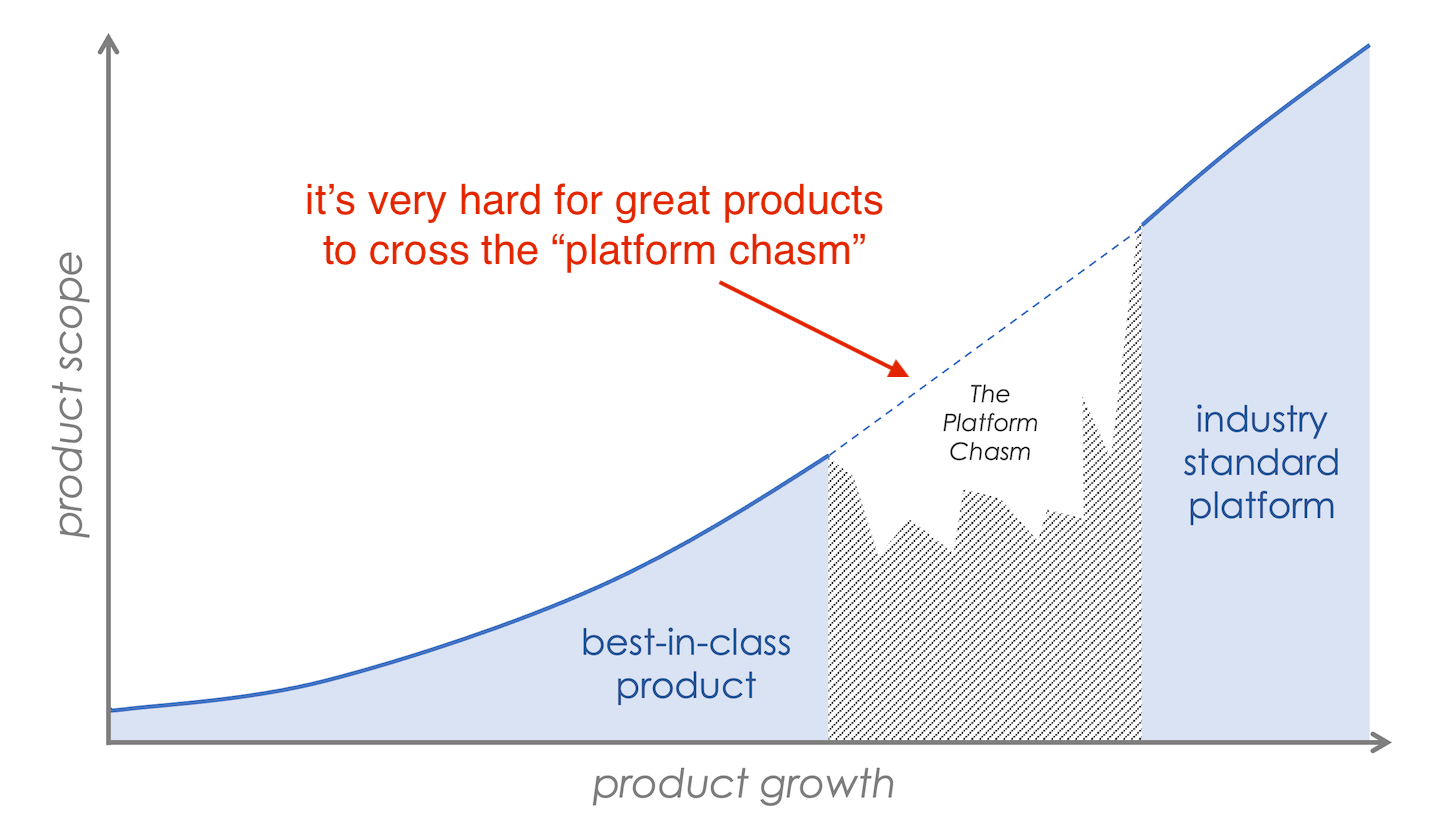

That may be an actual disgrace, as a result of in lots of instances, these are nice merchandise with joyful clients. Their specialization — the core mission they lovingly obsessed over — was their energy. They did X higher than anybody else did X. It’s simply that there was a restrict to the whole addressable marketplace for X. And attempting to maneuver past X not often succeeded at porting over the identical benefits of focus, experience, ardour, and creativeness that they’d had with X. Many lengthy to grow to be platforms, however most are unable cross that chasm.

Turning roll-ups from graveyards into gardens

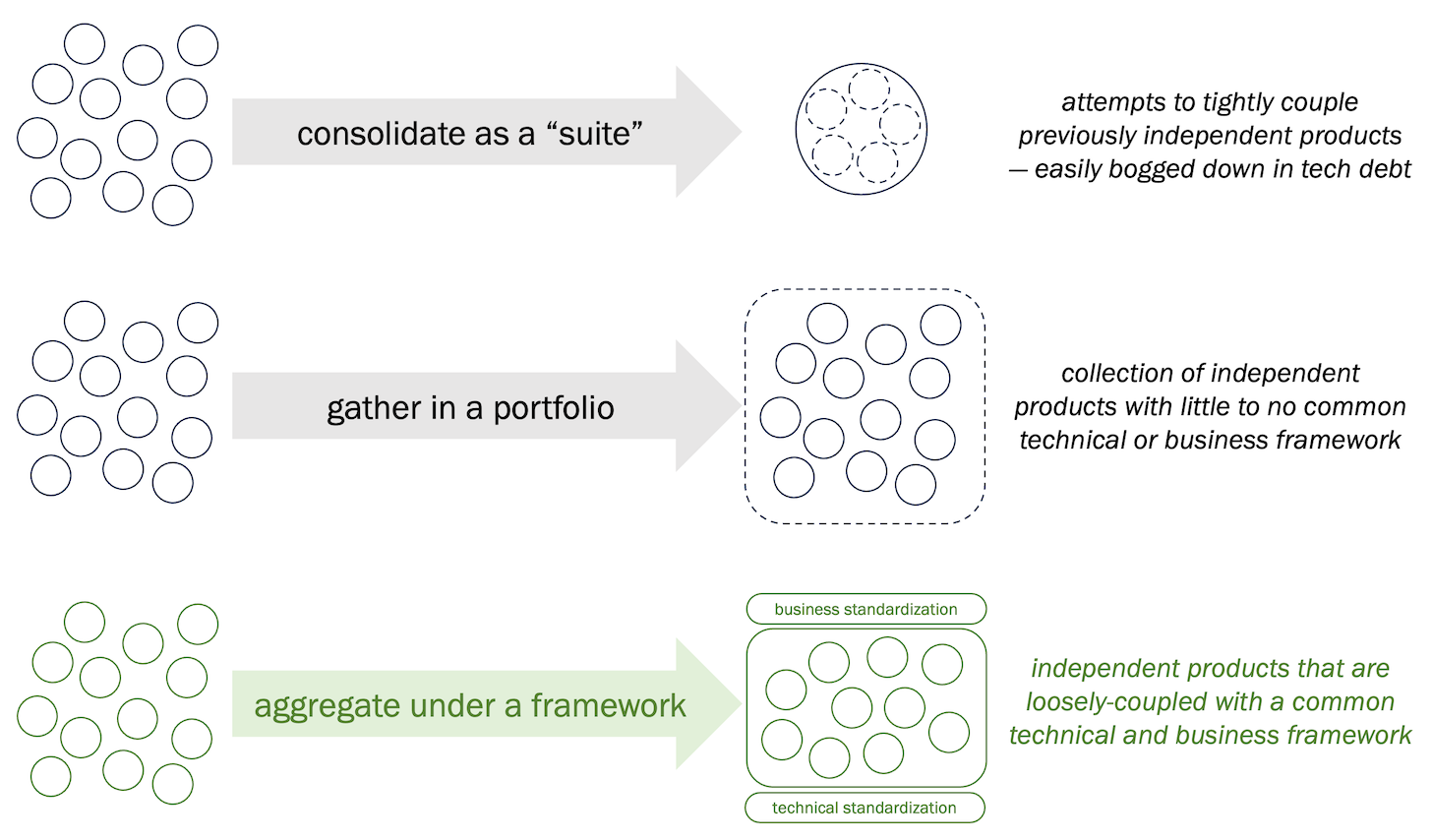

There may be one other path generally known as the “roll-up.” A closely financed firm or perhaps a personal fairness (PE) agency itself might purchase up a bunch of martech merchandise — typically at a discount fee from that cohort of the strolling lifeless — and both stick them collectively as a “suite” or just attempt to squeeze prices and clients to make them worthwhile as a portfolio.

Frankly, there aren’t a variety of stellar success tales on this path. Roll-up “suites” not often had sufficient cohesion outdoors of a PowerPoint slide diagram. And roll-up portfolios typically had little synergy amongst their merchandise. They had been normally extra about harvesting than planting, in case you get my drift.

Nevertheless, I consider there’s a greater method. Let’s name it a “martech aggregator firm.”

It assembles a set of best-in-class apps throughout totally different classes. It retains these merchandise largely impartial — there’s no try and mash them right into a Frankensuite. However there are a set of widespread technical requirements that every product should implement, largely to facilitate clean integration with the remainder of a buyer’s tech stack and guarantee them of all vital compliance necessities.

Buying will also be largely standardized to make issues simpler for patrons, with unified contracts and discounting. Patrons aren’t compelled to purchase a number of merchandise from the portfolio, however there are incentives once they do. There are additionally a set of shared enterprise applications for partnerships, schooling and coaching, and cross-product advertising and marketing to realize some legit synergistic economies of scale.

The secret’s that this aggreator firm is not run as a once-and-done consolidation or an end-of-life milk manufacturing unit. It’s nearer in nature to the foremost company holding firms — WPP, Publicis, IPG, Omnicom — which are structured to repeatedly evolve as leaders within the discipline. Some merchandise within the portfolio will fade over time. New ones might be added. The aggregator offers continuity throughout a continuously shifting martech panorama for each clients and buyers. It’s a revered model that incorporates revered manufacturers.

Blueprint for a martech aggregator holding firm

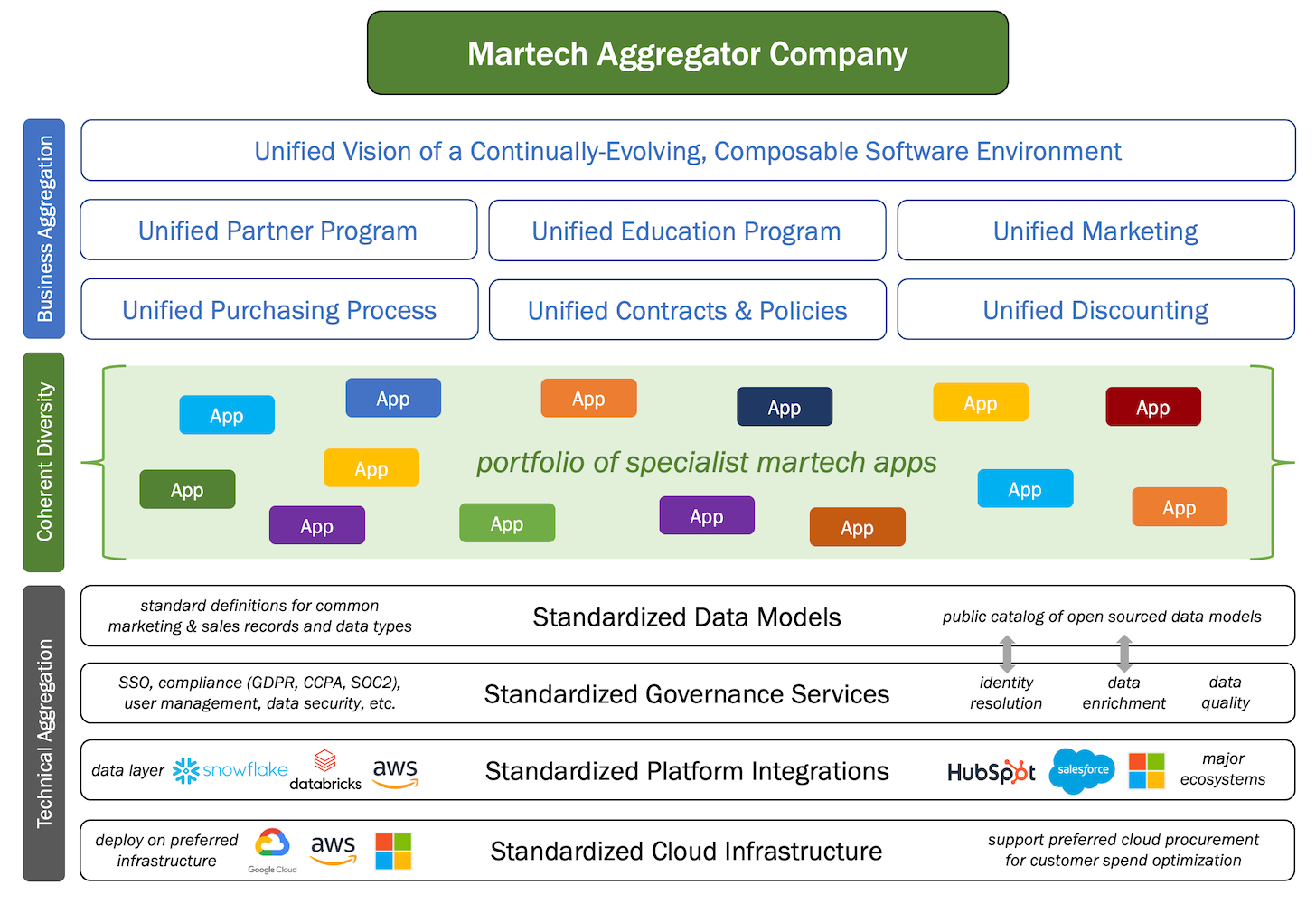

Let’s contemplate what the construction of such a martech aggregator firm might appear to be…

The center of the corporate is its portfolio of specialist martech apps. These shouldn’t be also-rans. They need to be among the many absolute best of their class. The fame of the aggregator — and its household of apps — rests on the premise that these are all nice merchandise. The aggregator must be seen because the champion of nice merchandise, assuring patrons that their favourite apps won’t be assimilated into an amphorous suite or milked dry as a dead-end asset.

Will it price so much to purchase these best-in-class apps? Completely. The financing required to execute this idea can be sizable. To make this work, the aggregator should grow to be a number one model within the trade, on a scale price billions. Premium merchandise at premium costs that ship premium experiences and premium outcomes.

The aggregator wouldn’t be a competitor to present public advertising and marketing clouds. Though there might be some overlap, its portfolio ought to extra ceaselessly complement these platforms. Certainly, enjoying good in these ecosystems is likely one of the core ideas of the aggregator’s portfolio. However it ought to attempt to be a model amongst these giants. Simply as Adobe, HubSpot, Microsoft, Salesforce, and so forth., are premium platforms in martech, this aggregator must be a premium portfolio. Once more, suppose the equal of Publicis or WPP from the company world.

There’ll doubtless be some aggressive overlap inside the aggregator’s portfolio. In any given class there could also be an SMB answer and an enterprise answer. Some might concentrate on explicit verticals or geographic areas, in helpful pressure with extra international horizontal apps. The aggregator ought to search to reduce direct competitors and redundancies inside its portfolio. However a bit inside competitors will be wholesome. Despite the fact that the analogy isn’t precisely the identical, be aware that WPP has beneath its umbrella a number of inventive businesses comparable to AKQA, Ogilvy, and VML.

The perfect of each differentiation and standardization

Every product within the aggregator’s portfolio is usually impartial in the best way it’s designed and engineered. It has its personal code base. Its personal person expertise. The core thesis of the aggregator is that differentiation is healthier than homogenization for best-in-class capabilities. New acquisitions don’t should be “replatformed.”

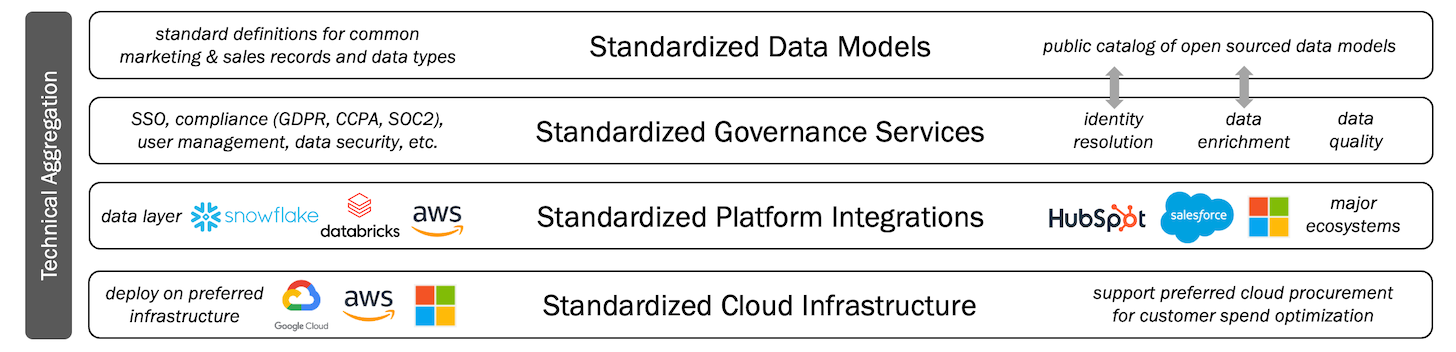

However there’s a layer of technical standardization that each app should assist, and that is the magic that makes the entire of the aggregator better than the sum of its components. Nearly all of those standardization necessities will be achieved by way of APIs or information mappings or with infrastructure choices that sit far under app-level performance. They need to not disrupt the character of what makes every app particular and distinctive.

The primary must be a push to standardize widespread information definitions. It’s really loopy that file sorts comparable to accounts, contacts, leads, offers, campaigns, and so forth. — or at the least their core fields — aren’t standardized in our trade but. It’s a part of what makes integrations and migrations so tough. The aggregator ought to set up these requirements, ideally as an open supply catalog. On the very least, it might probably guarantee the merchandise in its portfolio converge on these requirements, even when it’s by means of a knowledge mapping service.

The second must be standardization of key governance capabilities for all its merchandise. This contains assured compliance with all related laws GDPR, CCPA, SOC2, HIPPA, and so forth., so {that a} purchaser will be assured that any app within the portfolio meets these necessities. Commonplace SSO login choices with multi-factor authentication. A layer of world-class cybersecurity mechanisms and monitoring can be wrapped round all apps. Consumer administration and permissioning APIs are required for every product, in order that admins can see customers throughout apps and simply handle onboarding/offboarding. (The aggregator would possibly purchase its personal SaaS Administration Platform for this, however it will actually combine with the entire different in style ones.) Different shared providers for identification decision, information enrichment, and information high quality administration can present additional data-level cohesion, in a universally compliant method.

The third must be integrations with cloud information platforms and main martech platforms. Each app within the portfolio will need to have an open information mannequin and a excessive diploma of API protection that allows automation and orchestration by means of iPaaS, workflow automation, and AI agent platforms — in addition to any customized growth or integration a buyer desires. A purchaser must be assured that they will get any of the info from any of those apps into or out of knowledge platforms comparable to Snowflake, Databricks, BigQuery. And, the place related, apps ought to have glorious integrations into platforms comparable to HubSpot and Salesforce. “You’re a HubSpot store? Nice! Right here’s how our merchandise combine and add worth.” By integrating into a number of ecosystems, it might probably additionally give patrons the choice emigrate platforms with none interruption to their specialist apps.

It’s a composable world, with overlapping ecosystems all the best way down. A pillar precept of this martech aggregator is that openness and integration are how particular person best-in-class merchandise win. The aggregator’s model is constructed on this promise to patrons. (Such ecosystem integrations are most likely the largest elevate for apps within the portfolio to “standardize” on. This could both be a standards for evaluating apps to accumulate or, in some instances, an anticipated funding post-acquisition.)

After all, apps inside the portfolio can combine straight with one another too. However solely the place it is sensible.

Lastly, primarily each SaaS product is constructed on the cloud infrastructure of AWS, Google Cloud, or Microsoft Azure. Lately, all of those have created marketplaces the place apps which are constructed on their infrastructure will be bought and utilized in the direction of their cloud spend commitments (that are tied to their low cost ranges). It’s advantageous for patrons, particularly enterprise patrons, to buy by means of these marketplaces. Subsequently, the aggregator firm can provide a big profit by having all of its apps accessible in a number of of those marketplaces.

It’s extra work, however in a great state of affairs, the entire apps can be “multi-cloud” — in a position to be deployed on any of the foremost cloud infrastructures. The aggregator might then let patrons select whichever one is finest aligned to their technical or procurement preferences.

A couple of, key cohesive enterprise applications and processes

Every app within the portfolio ought to run as its personal P&L enterprise, with a wholesome quantity of operational freedom to match its vital independence in product administration and engineering. Nevertheless, there are actually shared company providers that may present efficiencies with out an excessive amount of constraint: accounting, authorized, workforce advantages, and so forth.

However there’s additionally alternative to unify sure sides of go-to-market for the apps and the aggregator as an entire the place it both amplifies collective influence or improves the customer’s expertise.

Whereas every app might have its personal gross sales crew — they know their product inside and outside, they’re captivated with it, it has an affordable scope for them to study and grasp — and/or a product-led development (PLG) movement, the precise buy course of itself ought to have a good quantity of standardization. Patrons ought to have the choice to handle a number of apps from the portfolio on a single invoice. Contracts and insurance policies (phrases of service, privateness insurance policies, et al.) must be standardized, so that after a purchaser vets the acquisition of 1 app, including extra ones incurs minimal procurement overhead.

One other ache level for a lot of martech patrons is opaque, Byzantine discounting practices by distributors. This is a chance for the aggregator to set an ordinary of clear, truthful pricing. And whereas every app works superbly by itself — nobody has to join a bigger bundle of issues they don’t actually need or want, i.e., suite-shoveled shelfware — there must be discounting incentives for patrons who undertake a number of merchandise from the portfolio.

Further alternatives for unified go-to-market capabilities embody accomplice applications, schooling and coaching applications, and a certain quantity of aggregator-level advertising and marketing. Every app ought to nonetheless have its personal advertising and marketing crew, even when they leverage shared providers for issues like adtech (the portfolio is an unimaginable “2nd-party” community of targetable account profiles and purchaser intent alerts!), occasion manufacturing, search engine marketing (LLMO?) experience, and so forth. However the aggregator model itself might even have formidable advertising and marketing capabilities for selling the advantages of its total portfolio. At scale, it might run its personal martech convention, combining all of the specialised experience from its app manufacturers beneath one roof.

A shared accomplice program that spans the portfolio additionally has nice potential. It’s typically onerous for specialist apps to develop a deep bench of channel and providers companions. There’s simply not sufficient scale. However collectively, beneath the aggregator’s model, there may very well be vital alternative for companions. Not each accomplice must promote or service each app. However as with patrons, there will be incentives for individuals who interact throughout the portfolio. As a result of the aggregator is inherently aligned with a number of main martech platforms, it might lean into present companions from these ecosystems who want to increase and deepen their answer choices.

(A query to contemplate at one other time is whether or not the aggregator must also develop a complementary portfolio of providers firms beneath its personal umbrella.)

Whereas the person apps ought to every have sturdy, opinionated leaders — once more, their relative independence is a supply of their energy — the management of the aggregator would steer the cross-app technique and operations of the entire. This would come with setting the widespread technical requirements and working the shared enterprise applications and capabilities. They’d determine how funding was allotted throughout the portfolio for present apps and when to accumulate new apps.

Above all, they’d be the champions of a brand new mannequin for a world-class martech “holding firm” that harnesses the progressive engine of a various martech panorama as a substitute of swimming in opposition to it. Aggregation over consolidation in an surroundings of composability, ecosystems, and fixed evolution.

Would you wish to work with an organization like that?